Live Sports CTV Advertising with Vibe

For years now, linear television publishers have been able to (somewhat) mitigate churn by serving their viewers arguably the most valuable long-form content on TV today: Live Sports. In fact, live programming of all types (awards, political, sports) have long guaranteed that advertisers and audiences both would keep coming back to linear, no matter what newfangled programming streaming services has to offer. According to Nielsen, four out of the five top-rated broadcasts among adults 18-49 in the last year were live sports focused.

But all of that is about to change.

Audiences are migrating to streaming their sports content en masse and cable companies are scrambling to stop the hemorrhage. While some cable services will cushion the blow by adding vMVPDs to their bundles, advertisers will be hard-pressed to resist the appeal of streaming TV’s targeted, programmatic advertising next to premium live content.

A Devoted Audience: Live Sports and Viewer Engagement

It comes as no surprise that live sports have one of the largest, most loyal audiences across platforms, but it turns out that they are also the most likely to engage with brands that advertise next to their favorite content. In fact, there’s a special kind of alchemy between live sports and television that advertisers are just now beginning to grasp: a recent report by The Trade Desk and YouGov found that 74% of marketers believe that buying CTV ads alongside live sports is more effective than traditional sports sponsorships.

As of today, more than 160 million Americans regularly watch live sports—nearly 50% of the total population – and of those millions, 78 million currently tune in on digital devices with that number projected to rise to over 126 million by 2027. In fact, 79% of sports fans say that, if they could, they would watch live events exclusively on streaming platforms.

Another reason interactive sports viewership continues to grow is the meteoric rise of sports gambling, which went from illegal virtually everywhere in the States just 4 years ago, to ubiquitous: total US consumer spending on gambling has skyrocketed—rising by 50% between 2020-2023—and is forecast to soar from $172.76 billion this year to $207.93 billion by 2027. Talk about an engaged audience!

Of course, as many of us have probably experienced in our own households, various leagues signing deals with separate broadcasters, streamers, and aggregators, has made finding the right game on the right channel at the right time feel like a nightmare straight out of Kafka, but that too is about to change. Recent publisher consolidations and viewership spikes are finally putting streamers in a position to make the kinds of billion dollar deals sports leagues have historically demanded from their networks.

How Live Sports entered the Streaming Wars

Free ad-supported TV (FAST) and hybrid video on demand (HVOD) are the two main models for live ad-supported streaming today. With the former, viewers get an experience similar to watching live, linear content, delivered over the internet on Pluto TV, Fubo, or the Roku Channel, for example, while HVODs require a small subscription fee for ad-supported content on streaming services like Hulu or Peacock.

By adopting an HVOD model, top streamers are now bringing in both subscription and ad-generated revenue, which finally allows them to compete with cable TV. That’s why media companies elbowing their way into the streaming space are finally taking on the last, most expensive, bastion of cable TV and pursuing sports rights.

A quick overview of recent media rights negotiations paints a promising picture for the future of streamed live sports. In just the last year, Thursday Night Football, Major League Soccer, and NFL Sunday Ticket have all made the move to streaming: AppleTV+ (MLS) Amazon Prime (TNF) and YouTube TV (NFL Sunday Ticket) now hold exclusive rights to major sporting events, while platforms like SlingTV and Fubo republish live sporting events as part of “skinny” cable bundles or standalone streaming apps.

Because big tech players often have more cash on hand (Apple has $64.2 billion and Google has $118.3 billion as of June 2023), they’re able to outbid legacy media companies (like Comcast at $$7.1 billion) without taking on liabilities, which further comforts analysts in their predictions the move to sports streaming is here to stay.

Meanwhile, lesser known but fast growing leagues in European soccer and college sports are diversifying their monetization strategies - and courting brand new advertisers in the process - by striking rights agreements with Peacock, ESPN+, and Paramount+, for example.

While billion dollar sports rights deals may have made more headlines than the steady growth of live programming aggregators like Fubo, the latter’s model is by far the most innovative and user-friendly for both viewers and advertisers, who can now easily access the games (and premium environments) through one platform and/or subscription, thus improving the user experience and minimizing the need for marketers to spread budgets across several platforms to reach sports fans and advertisers looking for solid ROAS this quarter should take notice.

In order to truly enhance live sports viewing and advertising experiences, streaming providers still need to optimize lag time and maintain reliability, but the technology behind complex CTV environments has improved exponentially in the last few years, which explains why media giants are finally making a real move to radically shift the live television model. Today, services like Sling, Amazon Prime, or Peacock are delivering live broadcasts with the same reliability and speed linear TV viewers have come to expect, and the list keeps growing.

The Benefits of Live Sports Advertising on CTV

Advertisers now have a vast array of options to engage directly with their sports-focused audiences, even within the streaming ecosystem. Of course large, exclusive, private deals will appeal to some, but the true paradigm shift here is that businesses of all sizes will have the option to advertise next to live sports programming programmatically, flexibly, and at any budget.

How to Find the Right Audience

On a streaming TV ad platform like Vibe.co, advertisers can log onto a simple, self-serve platform, enter their budget (at a $50/day minimum) and campaign duration, add their audience targeting criteria, and pick from two sports content options.

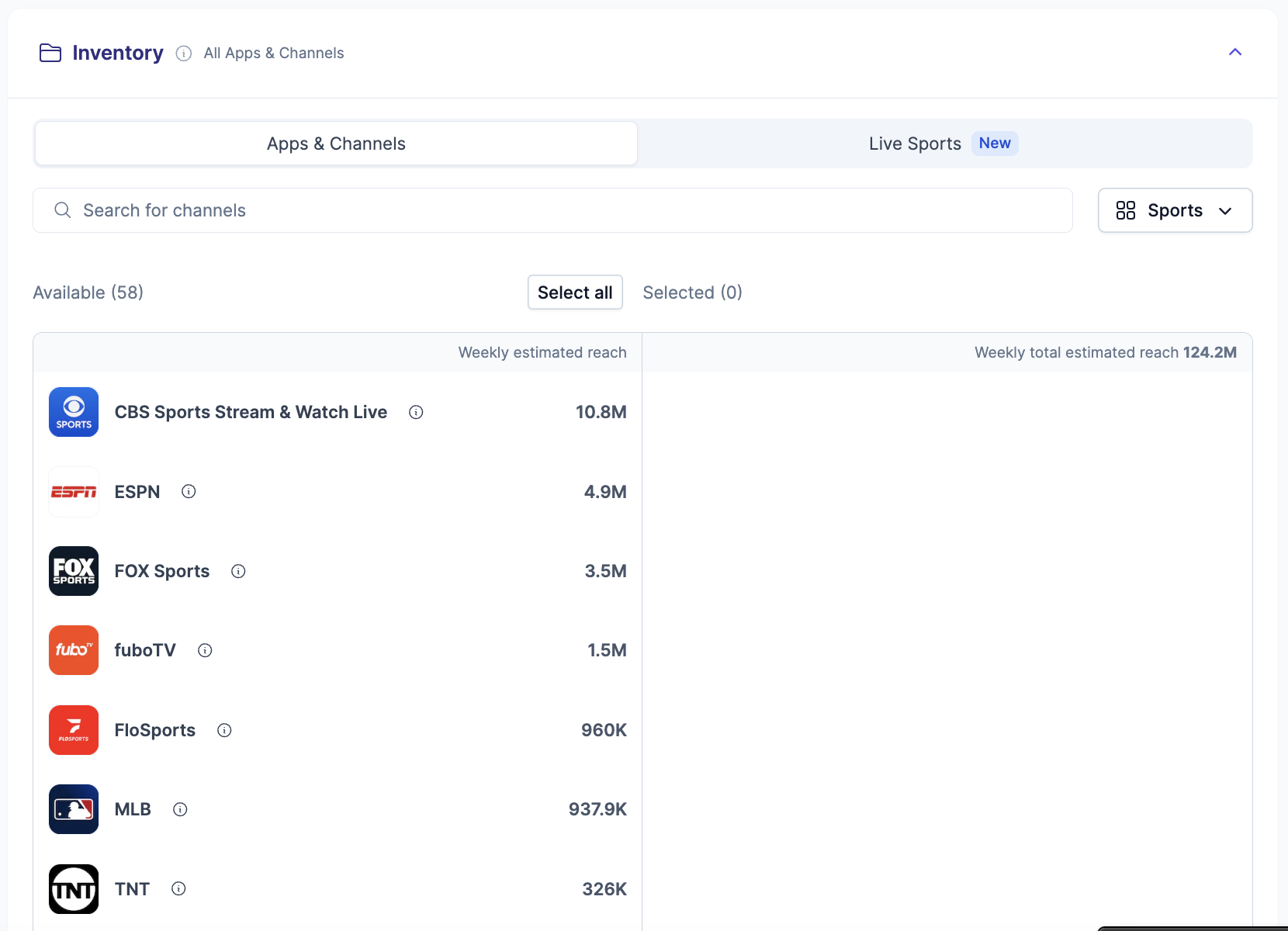

Their first option would be to simply select as many sports-related apps and channels as they wish from Vibe’s 500+ channel inventory and deliver their ads during custom time slots to engage with their sports-focused audience.

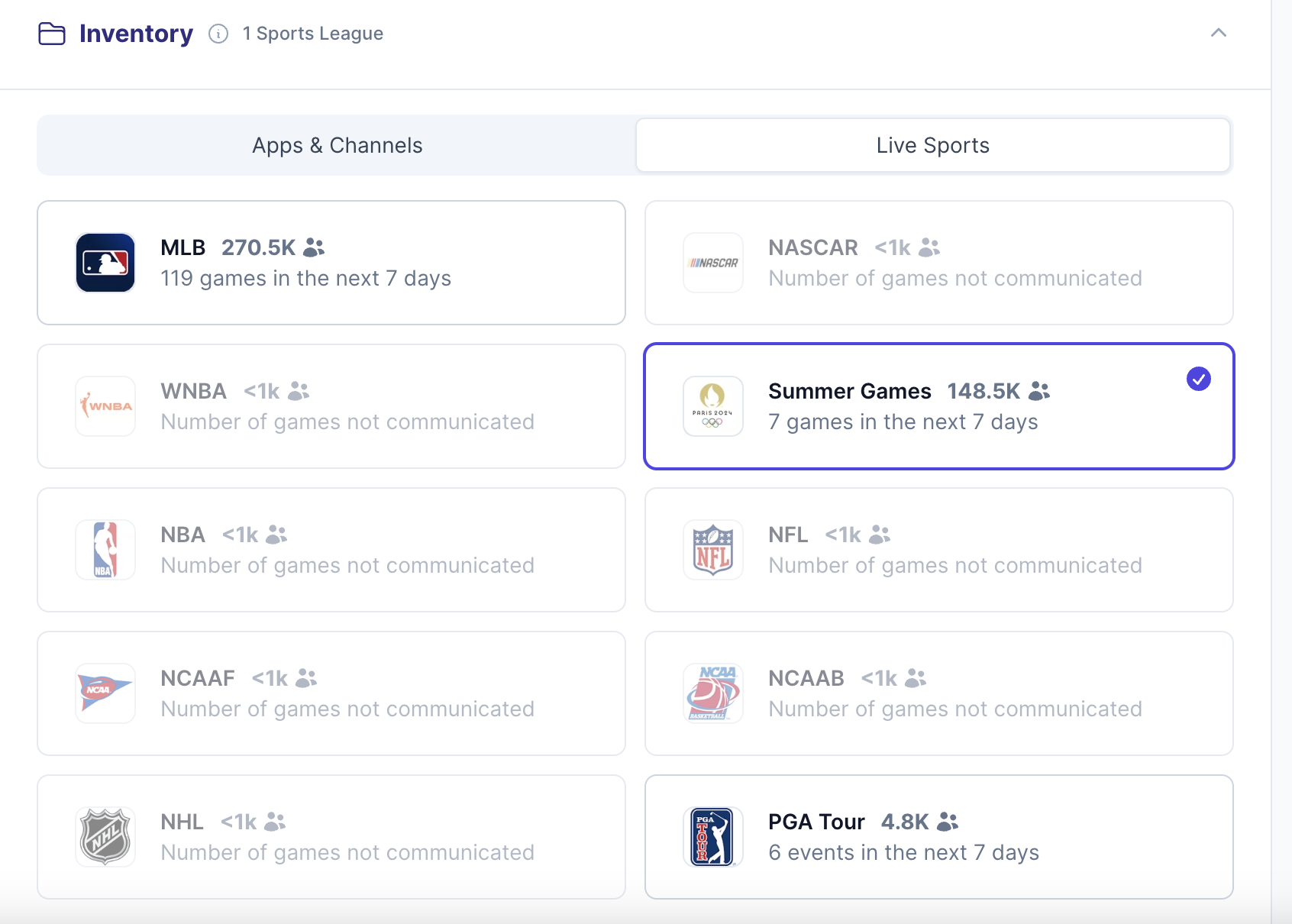

Their second, newer option would be to select which leagues their audiences are most likely to follow and Vibe’s AI will deliver their ads next to that league’s live sports content - wherever it might be streaming from.

This second option is a revolution in the way brands have thought about sports advertising for decades, especially now that streaming television has the viewership to back up their performance marketing ambitions. As of this year, 94% of US households are discoverable via programmatic CTV ad platforms and nearly half of viewers (44%) who watch sports are choosing a primary viewing source outside of linear TV. That number increases to 65% among younger sports viewers aged 18 to 34, as live sports viewership from digital channels has grown 30 percent in the last year.

Even as more fans watch live sports on digital platforms, 46% of live sports consumers say they prefer to stream sporting events on a big screen, which is why connected TV advertising is becoming a major player in the future of sports advertising.

As mentioned earlier, Connected TV audiences are also some of the most engaged, thanks to non-skippable, 100% viewable units which is why The Current recently reported they were “33 percent more likely to search for brands and products advertised during the game than viewers of ads on linear channels.” Those same targeted audiences are also highly customizable since CTV ads are served programmatically, using the same buying mechanism as programmatic display, dramatically simplifying audience targeting and measurement. Real-time campaign results from their CTV ad platforms now allow live sports advertisers on to create engaging, relevant content for sports fans at the right moments and with the right offers.

How Programmatic Media Buying Works

Programmatic purchasing of CTV inventory - across content types - is the most effective channel diversification tactic out there. It allows advertisers to reach customers across channels, while collecting more data to make value-based decisions and the flexibility to create a better experience for advertisers, consumers, and publishers.

With live CTV, ad creative can be served on the largest screen in the house, next to premium, live content, thorough programmatic pipes which are responding to hundreds of digital signals around audience types, geography, attribution, and more. Live content is especially suited to this type of delivery system because it’s unpredictable. Try as they might, publishers can’t plan ahead for free throws, injuries, or penalties, which free up extremely high quality unsold inventory that private partnerships couldn’t have accounted for.

After all, advertisers plagued by signal loss, increasingly stringent privacy concerns, and ever-more expensive upfronts know that reaching fans is getting harder and more expensive by the day. Streaming TV advertising is a powerful tool to reach fans during the game, but also across channels and content, long after the game clock hits 0:00.

Live Sports Advertising Best Practices

You’d be hard pressed to think of a better time to experiment with sports-focused CTV advertising: the SAG-AFTRA strike has left a massive gap in new content, pushing even more viewers towards live sports, news, and reality TV. Meanwhile, regional sports networks (RSN) are dipping their toes in the streaming pool: the Cubs, for example, launched Marquee Sports Network in February of 2020 as the exclusive broadcaster of Cubs games not shown on national TV, which can be streamed on FuboTV or the Marquee App. Finally, streaming claimed the largest share of TV viewing in July of 2022 and has continued to grow, even as other digital channels suffered a slow down earlier this year.

Before diving into some basic best practices, here’s how the process works in a nutshell: programmatic CTV advertising (as opposed to private deal based CTV advertising) allows advertisers to place ads next to live inventory in real time, through automated, real-time auctions. With a platform like Vibe, advertisers can purchase live impressions in NBA, MLB, NHL games—to name a few—within seconds, no matter where they are streaming. Ads are dynamically and safely served full-screen across multiple devices (mobile, tablet, tv), in minutes.

Here are some lessons we’ve learned along the way to create impactful live sports campaign:

Be Device Agnostic

Being device agnostic massively increases your campaign’s deliverability. Sports fans notoriously like to follow the game wherever they are, so excluding tablets and mobile devices from your device targeting could cost you millions of impressions. Wide targeting, especially at the beginning of a campaign, is also a great way to gather audience insights and optimize strategies in real-time.

Follow your Audience

Your customers love sports, granted, but they’re not spending every waking moment watching live games (probably), so it’s important to run complementary campaigns to follow them across apps, channels, and mediums. You could, for example, develop a strategy to run on sports-related (but not live event) channels like ESPN+, with more detailed demographic parameters like income, interests, age, or gender added in. You could also install traffic, lead, or purchase pixels on your website to measure your campaign’s impact or even retarget your web visitors on TV.

Go Wide

While other campaign types may benefit from granular geo or interest targeting, your biggest flex here is going to be placing your brand next to premium live sports content - so try to leave the rest pretty open. It’s best, for example, to target the NFL as a league rather than to pursue specific game opportunities, especially if you’re trying to reach a particular impression goal. Don’t get into a bind buying a specific game and failing to meet your goals with no backup options available. It will also enable you to benefit from unpredictable game delays due to injury, penalties, fights, etc. which could not be accounted for in a private game by game deal.

Lean into Performance-Focused Creative

Much time is wasted hand-wringing over the development of Oscar-worthy ad creative, but CTV advertising is about performance. Your audience is already laser-focused on the content on their screens, so you need to make sure your message gets through loud and clear. Don’t be afraid to keep your url on-screen for the length of your ad, accompanied by a visually and aurally compelling CTA.

At the end of the day, live sports programming is the last bastion of old-school television viewership keeping audiences tethered to their cable boxes. Its massive migration to CTV will only accelerate a metric rise, as US CTV ad spend soars to $38.83 billion by 2026.

Ready to learn more about CTV advertising? Explore the Vibe platform or book a demo!