How CTV became a performance channel - with Vibe.co and Adjust

In the beginning, there was fire - stolen from a neighboring cave, perhaps - makeshift families gathered around primitive campfires for warmth and safety, but also community and entertainment. Then came announcements in town squares, gathering around the gramophone in the parlor, FDR’s radio “fireside chats,” and finally, you guessed it, television.

Television as the modern day campfire

Like it or not, TV has become our modern-day campfire, where we congregate around Friends reruns, gasp at new episodes of Succession, and roll our eyes as we begrudgingly join Bachelor Nation. Often vilified as a mindless activity sucking the life out of our children, it is now rehabilitated as a nostalgic medium where families can bond over a basketball game or a Sponge Bob marathon instead of staring at Candy Crush alone in bed.

In a world of 5 second soundbites and lonely doom scrolling, no digital channel can pack a story-telling punch like television, which still boasts the highest engagement and view-through rate (97%) of any marketing channel by far.

A massive consumer shift to CTV and OTT

Long considered a legacy channel exclusively available to brands with huge budgets and long-term omnichannel marketing strategies, television advertising has been radically transformed by a rapid consumer shift away from broadcast and cable, to streaming. The shift had already slowly begun when Covid hit in 2020, but the CTV market growth entered super speed as homebound viewers reassessed their entertainment priorities.

Today, according to a recent survey by eMarketer, over 53% of video viewing on all devices is on CTVs. That means more people are watching streamed content on CTVs than videos on social media and linear TV combined. Woah.

In fact, 85% of all US households with a television own at least one Connected Television device, while Vizio reports that nowadays less than one-third of all TV viewing is linear (traditional tv) compared to 60% from just two years ago. Several major streaming services saw double-digit growth in viewing time, with Netflix, YouTube and Hulu experiencing increases of 26%, 21%, and 13% year over year, respectively.

Beleaguered Digital Advertisers Are Ready For An Upgrade

So what is CTV exactly, and why are advertisers just as eager to allocate budgets to this brand new medium as consumers are to ditch their antennas and cable subscriptions? Well, we thought we’d go ask Vibe.co partner and CTV expert, Gijsbert Pols, Director of Connected TV & New Channels at Adjust, to hear his take.

Full disclosure, we arrived at our interview ready to bash Apple’s ATT and blame it for everything under the sun - Mercury in retrograde, that gross orange juice taste after you brush your teeth, and most importantly, the stunning loss of signal pushing mobile advertisers to CTV in droves, but guess what? It turns out it’s more complicated than that.

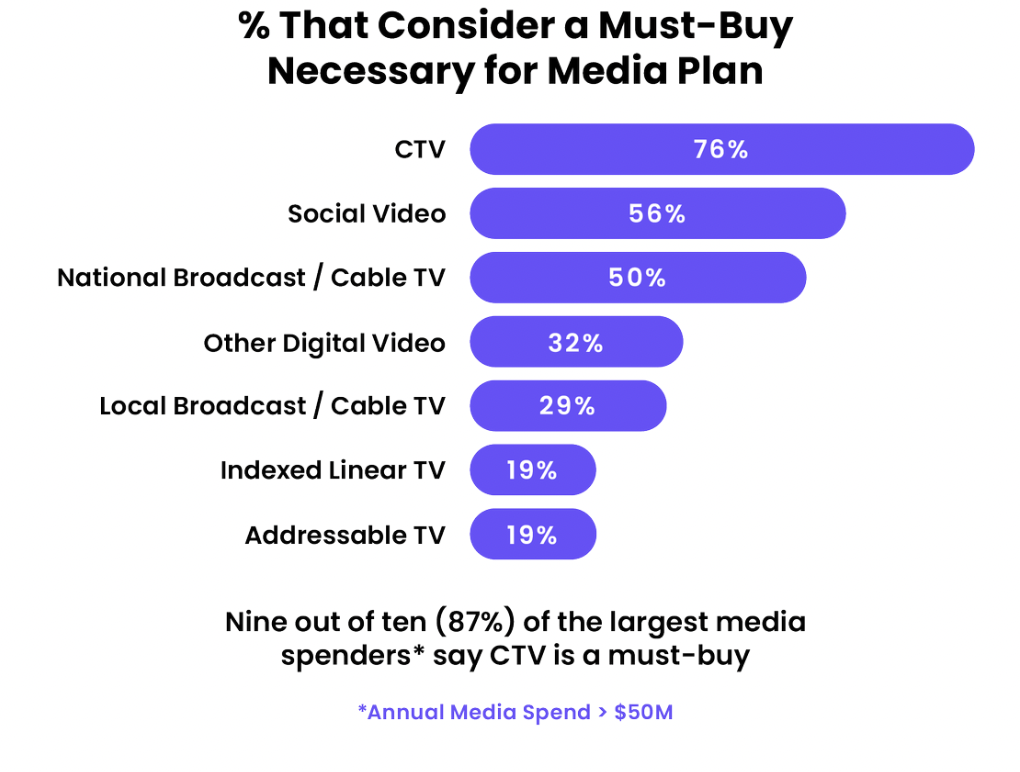

First, let’s be clear, Pols agrees with one thing for sure: CTV advertising is surging and doesn’t show any sign of slowing down soon. The reasons for this surge, however, are more complex than the disappearance of IDFAs on Apple devices. For Pols, the top 4 factors shaping the CTV landscape today are:

- A paradigm shift in long-form content consumption. Television viewers flocked to streaming content during COVID, but their habits are continuing to evolve in sometimes surprising ways: a recent study by video analytics solutions provider NPAW reveals that audiences are spending longer stretches of time watching fewer programs on fewer channels (increasingly AVOD and FAST). That means advertisers are contending with a more engaged audience, but also an even bigger need to target and track campaign performance. Because viewers are still exploring CTV options and channels, it is crucially important for advertisers to broaden their reach across streaming platforms instead of putting all of their eggs in one publisher’s basket. That’s where powerful DSPs like Vibe can really supercharge a campaign.

- Advertisers reallocating mobile and desktop display budgets to CTV. While digital advertisers focused on video are still definitely spending large chunks of their budgets on display ads, it is crucial to recognize the increasingly large portion of video advertising budgets being diverted to CTV campaigns. Compared to other digital video types, CTV provides more transparency into where ads run: 59% of buyers stated being “very clear” on where their CTV ads ran vs. only 50% and 43% for social video and other digital video, respectively. According to IAB, “Buyers are turning to CTV (which does not rely on third-party cookies) as a privacy-safe way to spend ad dollars efficiently and effectively. Nearly three in four (73%) video buyers expect to fund their third-party cookie/mobile ID deprecation CTV spending increases by reallocating dollars from linear TV.” That’s why Vibe offers transparent, real-time reporting, so clients can optimize their campaigns as they progress.

- 3. A net new acquisition channel. Forget about the cord-cutters, what about the cord nevers? An entirely new set of viewers are leap-frogging from exclusively consuming digital content to becoming avid CTV consumers. How often do marketers get the chance to unlock a brand new audience? The last time advertisers got to experiment with a radically new digital medium was at the dawn of social media ad monetization, and look at how far that’s come! Adding a new channel to established advertising mixes is slowly becoming the silver bullet for mature industries like gaming, worried about cannibalization and wasted impressions.

- 4. Inventory growth. An unanticipated CTV audience surge beginning in 2020 led to exponential premium inventory growth on the publisher side, especially for FAST (Free Ad Supported Television) and AVOD (Advertising-based Video on Demand) publishers. Even SVOD companies are now exploring AVOD and FAST formats (hello, Netflix!) That’s great news for advertisers who can benefit from lower than anticipated CPMs (Vibe CPMs hover between $12 and $20) and the opportunity to place their brand next to premium long-form content instead of nana’s 100th rant against “lizard people” on social media.

The power of TV with the trackability of digital

Ok, now that you understand the reasoning behind advertising budget reallocations to CTV, how do you make the most of it? Well, you don’t manage until you measure, and that’s doubly true with a new tool in a fluctuating market. It’s important to understand that while CTV promises the granularity of digital advertising coupled with the power of television storytelling, advertisers will still need to learn a new “key” of sorts to understand the CTV measurement landscape.

For Pols, CTV advertising is a digital acquisition medium all its own, that probably won’t pay off if you measure results the way you’re used to. Its true value lies in new capabilities that follow a new measurement paradigm:

- Incremental reach. Sure you can track impressions, CPMs, ROI, and ROAS for your CTV campaign, but what’s really exciting is the incremental reach working with a brand new user acquisition channel can achieve. Incremental reach is the degree to which your brand engages with households who are otherwise unexposed to a traditional or linear ad through CTV and digital. It’s a crucial performance marker for any mature digital user acquisition campaign, and still relatively complicated to measure, which is why you’ll need a good measurement partner. That’s where Adjust comes in, but more on that later.

- Assisted user acquisition. While Multi Touch Attribution has been touted by some as the best new measurement paradigm for complex customer journeys, it’s already losing some of its luster: what’s the use of a shiny new tool if it’s too dang complicated to operate? There’s a reason everyone remembers E=MC2, and not the more accurate but less elegant formulas developed by Einstein’s peers. If advertisers want to implement data-driven practices across all of their teams, their measurement systems need to be user-friendly. For that reason, we recommend clients stick to last touch attribution, while keeping in mind that - particularly in a CTV context - upper funnel ads matter. Measurement partners like Adjust, for example, can now track which channels assisted the user acquisition along with the ultimate conversion channel. As 92% of television audiences report using at least one other digital device (usually their phone) while watching tv, it’s key for advertisers to learn how their CTV ads fit into a larger customer journey.

- Long tail user acquisition. Much has been made of CTV’s power to democratize television advertising, finally allowing SMEs to enter the TV marketing game, but it has also proved a boon for a different market segment: niche retail. While traditional TV advertising was like shooting big game with a shotgun - making a big impact, but only by “shooting” ads all over the market, whether audiences were interested or not - targeted CTV advertising offers sniper-like precision. So even though it didn’t use to make sense for, say, a vintage macrame retailer to spend money on ads that would only interest 2% of a traditional DMA audience, it now makes all of the sense in the world for them to use the power of big screen storytelling on their target audience.

The Future of CTV

Building on the strength of groundbreaking deliverability and measurement capabilities, Pols anticipates exciting developments in the next 5 years, some of which have already begun:

- Shoppable Ads. The great CTV tracking conundrum is already becoming much simpler to solve as the sector matures, standardizes metrics, and develops robust measurement parameters. The advent of shoppable ads, however, will close the measurement loop in ways we can’t even fully fathom yet.

- Cross-device targeting. As the CTV ecosystem matures and industry standards solidify, advertisers will be able to implement a far more holistic approach: telling their brand story on the big screen, creating awareness using voice, and even out-of-home and trigger interaction through mobile. Even more exciting, advertisers will work to convert audiences on every device, making sure they can offer products and services on all device types. Says Pols: “It's not just using channels on all devices to convert users on one device, but using all channels on all the devices to convert users on all devices.”

- New CTV verticals: One of the most exciting developments Mr Pols is watching in CTV right now is the emergence of brand new, community-focused verticals like gaming, education, and faith-based programming. According to Pols, “Looking at the sheer numbers of apps, gaming is the second-largest category on Amazon Fire TV and Apple TV. In November 2020, there were 797 gaming apps on Amazon Fire TV, or 17%, of the total 4,744 apps. On Apple TV, gaming represents 3,633, or 22%, of the 16,241 apps. None of the other categories (sports, music, lifestyle, etc.) comes close to these figures.” While educational and faith-based apps are nowhere near gaming numbers yet, we’ve all experienced the power of hybrid learning and worship environments during the worst of the pandemic, and it seems inevitable those learnings will shape the future of CTV.

So where do we go from here?

Of course none of this means anything without the right partners, which is why Adjust and Vibe.co are partnering to deliver the very best in CTV delivery and tracking.

Earlier this year, Vibe.co launched the first self-serve programmatic CTV platform focused on performance, allowing marketers to go live in minutes with no budget constraints, no contract processing delays, a custom channel mix, real-time reporting, precise targeting, and pixel and MMP tracking.

Meanwhile, our friends and partners at Adjust have launched a brand new CTV Assist dashboard to solve for this very issue. Vibe clients who leverage Adjust as their MMP will be able to determine the holistic impact of their CTV campaigns and assess the impact CTV plays in assisting installs and revenue from users converting via down-funnel channels. For example, you can now break down mobile app users attributed to, say, Google Ads, by how many were also exposed to a CTV campaign. Without such an analysis, a purely last-touch approach to attribution will leave the performance of your CTV efforts feeling sub-par, so don’t settle for less any longer!